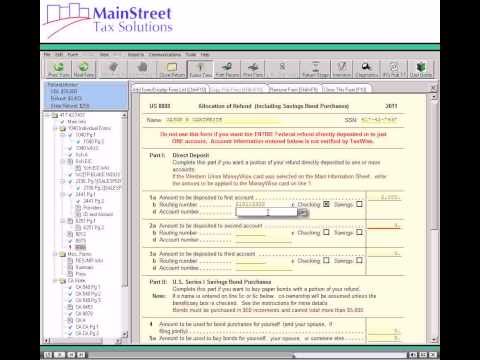

Hello and welcome to our software tutorial series. In this tutorial, you will learn how to request a direct deposit of a refund into two or more bank accounts. In the tax preparation software, taxpayers have the option of having the refund deposited into two or three accounts at a bank or other financial institution. This can include checking, savings, individual retirement arrangement (IRA), health savings account (HSA), Archer MSA, or a Coverdell education savings account. Additionally, taxpayers also have the option to buy up to $5,000 in paper Series I savings bonds with their refund. If your client wants the refund deposited into only one account, do not complete this form. Instead, you can request a direct deposit of the refund on the tax return being filed by filling out the bank account information on the main information sheet and then verifying that information on Form 1040, page 22. To enter the allocation of the refund, including savings bond purchases, into the software, click on the "Add Form" or "Display Form List" tab at the top of the active form or press Ctrl + F10. In the "Look for" field, type "8888" and then press Enter. The software will load and display Form 8888. On Part One of Form 8888, you can specify the portion of the refund to be directly deposited into each account. Each deposit must be at least one dollar. The total of lines 1a, 2a, and 3a must equal the total amount of the refund. When entering the routing number and account number, make sure the routing number is nine digits and starts with 01-12 or 21-32. Any other routing number will result in the direct deposit being rejected, and a check will be sent instead. If the check states it is payable through a different financial institution than...

Award-winning PDF software

8888 good or bad Form: What You Should Know

Oct 10, 2025 – 9 Reasons Why You Are Seeing 8888 — The Meaning of 8888 Mar 16, 2025 — A direct deposit to your IRA or 401(k) can be made from any bank ATM or credit card. Direct deposit of an income tax refund can be made from a checking account as long as you report the payment to the IRS. Also, tax refunds can be sent directly from a financial institution (such as a mutual fund company). 9 — The IRS has released a policy for direct deposit of a refund in response to a petition filed through the “Filling Out Your Return Now—Refund” online form. Form 8920-T for Direct Deposit of Form 8888 May 25, 2022— Form 8920-T Direct Deposit Notice: You have now filed Form 8920-T Form 8920-T. You have now asked for a refund because you know you can't pay it to yourself. For a more detailed explanation as to why Form 8888 is a good idea, see these articles: Why are we seeing angel number 8888? Why do Americans see 888? Here is an article that explains how Angel Number 8888 is not just a one-time event, but rather something that changes over time.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8888, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8888 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8888 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8888 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8888 good or bad