Award-winning PDF software

8888 2025 irs Form: What You Should Know

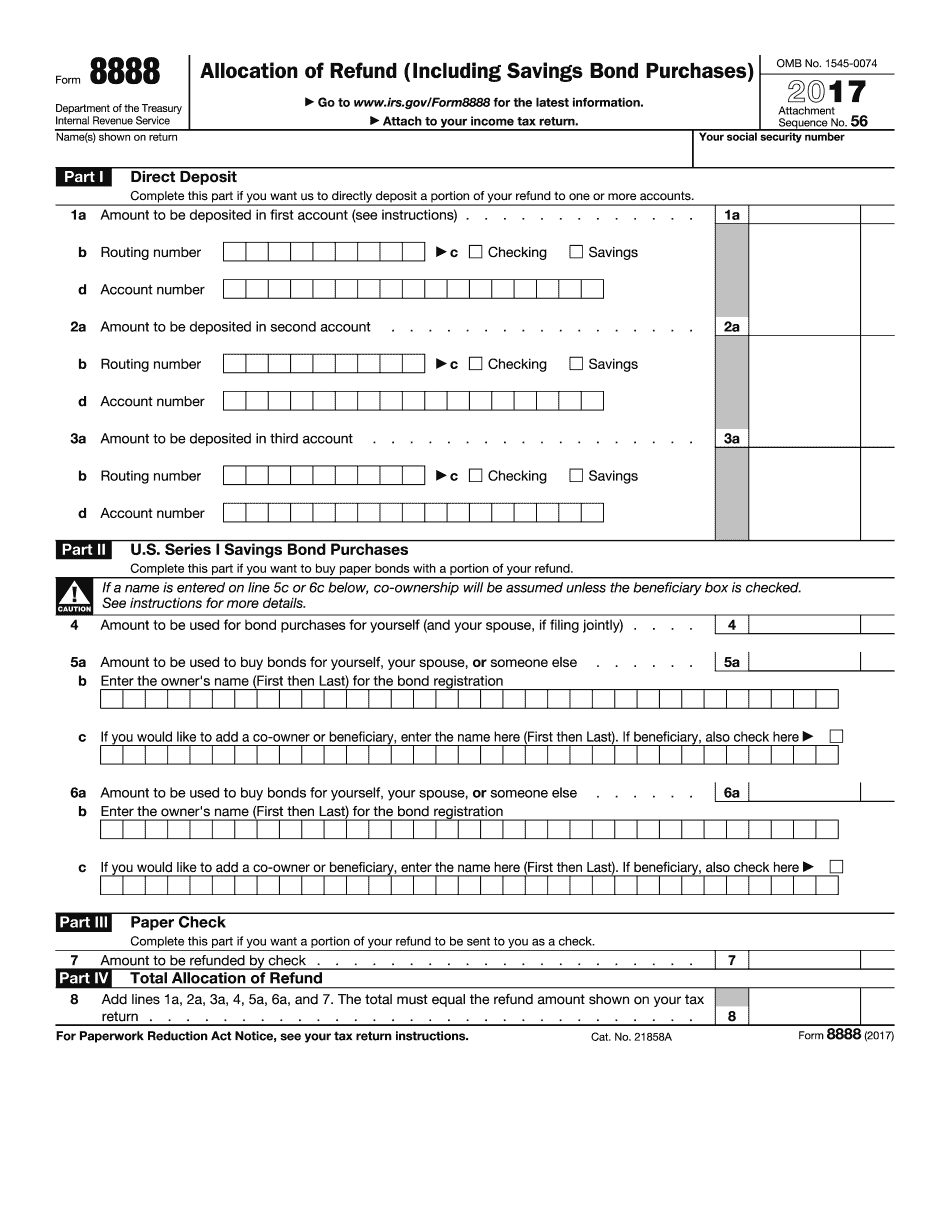

Allocation Method. Use this method if all the following apply to you: • You must deposit this refund into the same or different (and not interrelated) accounts in the United States; • This refund must be deposited to account holders using the same taxpayer identification number (CTN). A deposit to the same account within 15 days will generally be considered interrelated, which is why the IRS recommends that you deposit all of your tax refund to as many accounts as possible so that any refunds can be combined Amount of Interest. The interest amount used with the Form 8888 is an annual percentage rate based on the lowest tax rate paid that quarter for balances from 0 to 10,000. If you use a higher interest rate, then the amount your refund takes up at the end of the year will be different Interest Rates of the Previous Year. If the interest rate on your refund is higher than the interest on the tax return you used as your basis when determining your deduction, then the excess interest you'll be able to apply towards lowering your tax liability No Transfer Fees, Annual Fee, or Depositing or Withholding Fee Form 8888: Direct Deposit of your Tax Refund to Oct 16, 2025 — Part I of Form 8888 allows you to allocate the tax refund across three different accounts. You'll need to include each account and routing number on this form • If you want to deposit all of your tax refund directly to as many accounts as possible, we recommend that you use this method • If you want a larger amount of money to be deposited each month, we recommend using the direct deposit method to make a larger deposit • Use Form 8888 (in lieu of Form 8442) for a deposit into an account you previously opened (or which you used as your basis for you to determine your tax deduction) Maximum Amount of Interest. The interest amount used with the Form 8888 is an annual percentage rate based on the lowest tax rate paid that quarter for balances from 0 to 20,000. If you use a higher interest rate, then the amount your refund takes up at the end of the year will be different Note: As of June 13, 2019, the lowest tax rate for the 2025 calendar year is 10 %. The lower tax rate for tax years ending in April 2019, April 2020, and April 2025 falls to 9 %.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8888, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8888 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8888 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8888 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.