Award-winning PDF software

Chicago Illinois Form 8888: What You Should Know

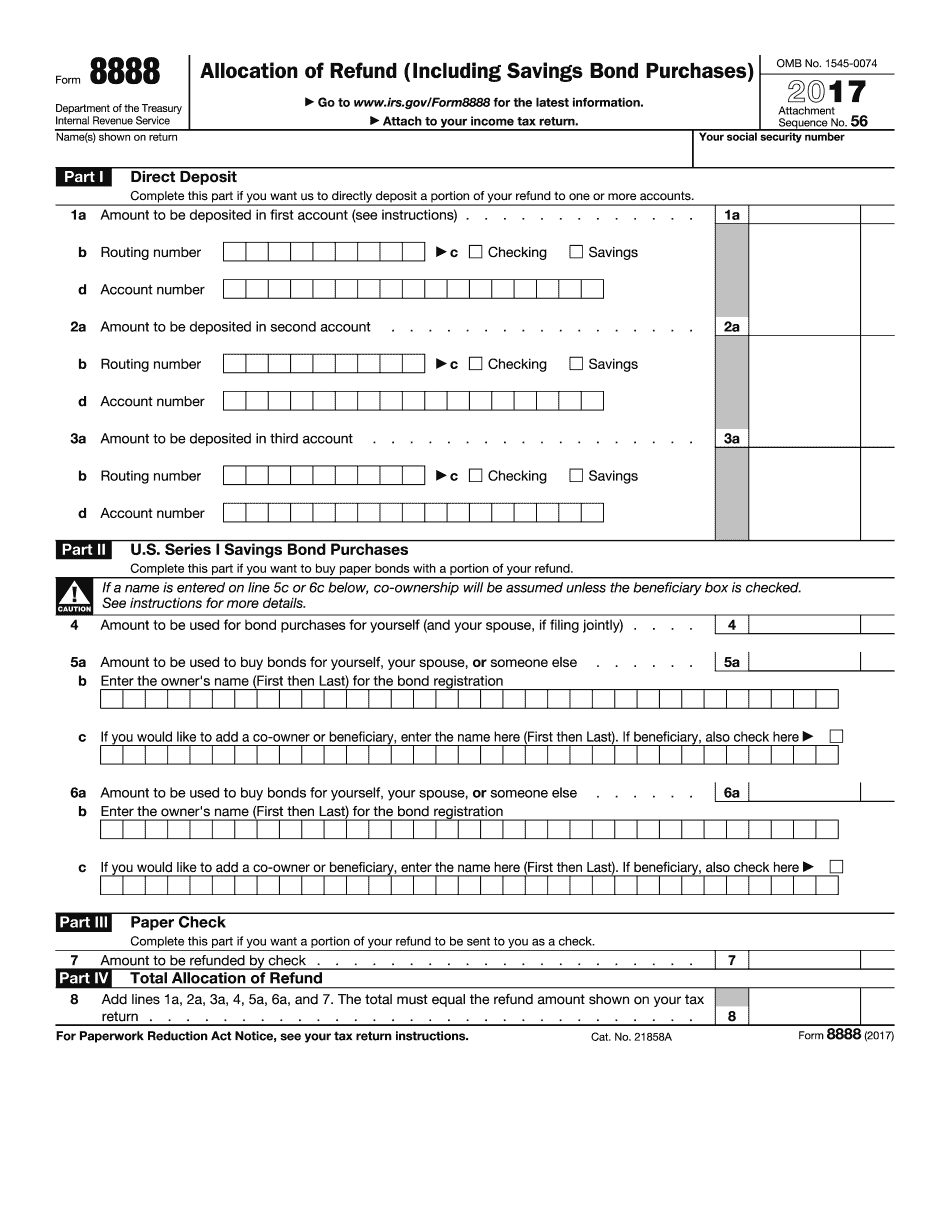

If You Received a Penalty on Your Credit Card, You Are Not Eligible To Receive A Refund on Your Tax Return.”. Chicago, IL 60605. What form is it? Form 8888. Which state? If you purchased a gift certificate from an Illinois store, contact them directly to see what form you must fill out. Who can you take an additional refund? You may also take an additional refund from the Illinois Department of Revenue, which is a separate form. For Individuals: Refund Us Chicago, a program to provide grants to individuals who are unable to receive a refund of federal taxes based on tax loss. The program accepts Federal Form 4868 — Income Tax Withholding Certificate for a refund. For corporations: Policies and Procedures for Corporate-Related Refunds in Illinois. How to Request a Proof of Identity For Non-U.S. Citizens. Illinois Identification of Non-U.S. Citizens (Illinois Secretary of State). Proof of Identity For Non-U.S. Citizens (U.S. Department of State). Illinois Identification of Persons Eligible To Apply for a Non-American Identification Card. The Illinois General Assembly has enacted laws permitting the Department of State to issue or issue by mail a U.S. Passport to foreign individuals who: Have a parent or spouse who is resident in Illinois or a state that recognizes American immigration law; and Provide an Illinois Passport with an Illinois address. The Illinois Department of State issues a passport to a foreign individual on receipt of the following information: Illinois Foreign Relations Law (Sections 524, 542). The passport must include the person's signature. Illinois General Assembly Law (Sections 6-9). How to Make an Affidavit of Citizenship or Immigrant Status Applicant's Name, Address, Photo, and Proof of Identity. Affidavit must be prepared, signed and notarized in not less than 10 pages of notary required. A copy of this document must be provided together with a current Illinois-issued driver's license or non-driver's identification card, a signed copy of the Uniform Driver's License, Federal ID card, or other non-driver identification, proof of address such as utility bill or bank statement, or payment of the non-refundable Illinois income tax or non-taxable state income tax, if a non-resident of Illinois.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Chicago Illinois Form 8888, keep away from glitches and furnish it inside a timely method:

How to complete a Chicago Illinois Form 8888?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Chicago Illinois Form 8888 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Chicago Illinois Form 8888 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.