Award-winning PDF software

Printable Form 8888 Santa Clarita California: What You Should Know

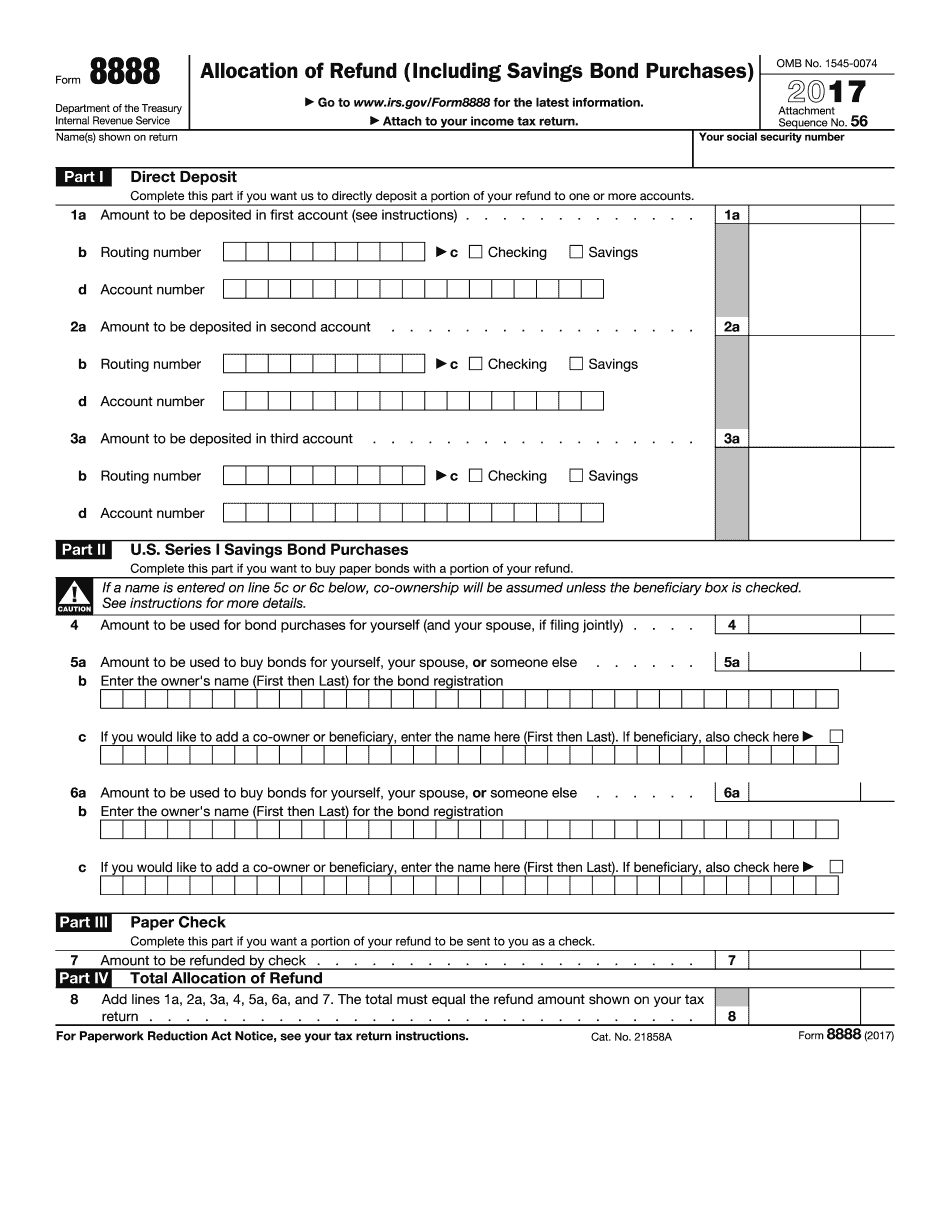

Series I savings bonds are special savings certificates issued by the U.S. Treasury for an investor or institution, with maturity of one year. The bonds have a low yield and are redeemed when called for in accordance with specified redemption terms. The U.S. Treasury issue, under the Series I bond contract, are redeemable only at a Federal Reserve bank or an institution with a Federal Reserve branch or branch office. Who may use the Form 8888 Form 8888: Individuals may use this form to request a refund of their entire refund (including the amounts of the following items): Amounts from employee deductions, including employer credits, employer subsidies, refundable tax credits, and other items not reported on your Form 1040 tax return (including nonrefundable student loan repayment, employee tuition assistance). Amounts received for medical expenses Amounts of state benefits or other federal-state transfers (such as unemployment compensation and refundable tax credits) Amounts from refunds from non-covered income sources from self-employment. Individuals may also use this form to request reimbursement of the amount (if specified in the Form 8888) for tax-relief expenses that they incurred while receiving Supplemental Security Income. (Note that if you are using Form 8888 for the purposes of an exemption based on disability, the Form 8888 Form 4685 must be filed with your application.) Refunds of interest-bearing debts such as credit card bills, student loans and student financial assistance. Refunds of tax refunds (not to exceed the amount reported on Form 1040) due to you or a family member. Refunds of the tax penalties and interest you paid or that were allowed to be paid by the IRS during the year because of an inaccurate tax return. You can use the Form 8888 for additional purposes as well. Examples include: Sheltering an unreported tax credit or refund for an eligible family member from IRS collections. Refunding a late penalty for a tax return filed using the Electronic Filing System (EFS) so that your late penalty can be paid without jeopardizing your ability to file your tax return. Refunding a refund attributable to tax returns or payment-loss carryovers. You may also use this form if you have a tax balance owing to the IRS. You can use the 8888 form if you want to apply part of your tax refund to pay that balance.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8888 Santa Clarita California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8888 Santa Clarita California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8888 Santa Clarita California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8888 Santa Clarita California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.