Award-winning PDF software

Printable Form 8888 Rhode Island: What You Should Know

S. Treasury Department's (Treasury's) regulations. Form 8938, Report of Foreign Bank and Financial Reporting and U.S. Treasury Regulations regarding the Reporting of Foreign and Financial Affairs by Foreign Financial Institutions (Form 8938) The U.S. Foreign Account Tax Compliance Act of 2025 (FATWA) is a U.S. tax law passed in 2025 that provides the IRS the authority that it needs to enforce the reporting and payment Of tax on U.S. sources of income and business interest. U.S.-Colombia Tax- Avoidance “How Do Money Transfer Companies Keep Filing Their Tax Returns?” This has been a very popular series for the Blog. If a company does not file an annual U.S. tax return it is not likely that such company will be allowed to file another one that year. The IRS has been enforcing some of their regulations and has a fairly good track record of what they will do to claw back some benefits from some of the largest U.S. non-resident holding firms. Some of these benefits include a) Filing with no deductions for business expenses b) Deducting expenses for the purchase or lease of all or many non-U.S. assets c) Deductions/exemptions (usually non-U.S. property or business interests) for interest (sometimes referred to as “tax deferral”) In January 2025 the IRS announced its interpretation of FIT (FATWA) as “the principal vehicle, and only vehicle, for taxing the flow of money in and out of the United States of the beneficial owners of U.S. entities.” It has been interpreted as applying only to property owned by companies controlled by U.S. taxpayers, and not to the beneficial owners of these companies. Therefore, it is not necessary for U.S. companies to pay any tax on the flow of capital, as long as they file their tax returns every year; that is, they are not required to file Form 8938.

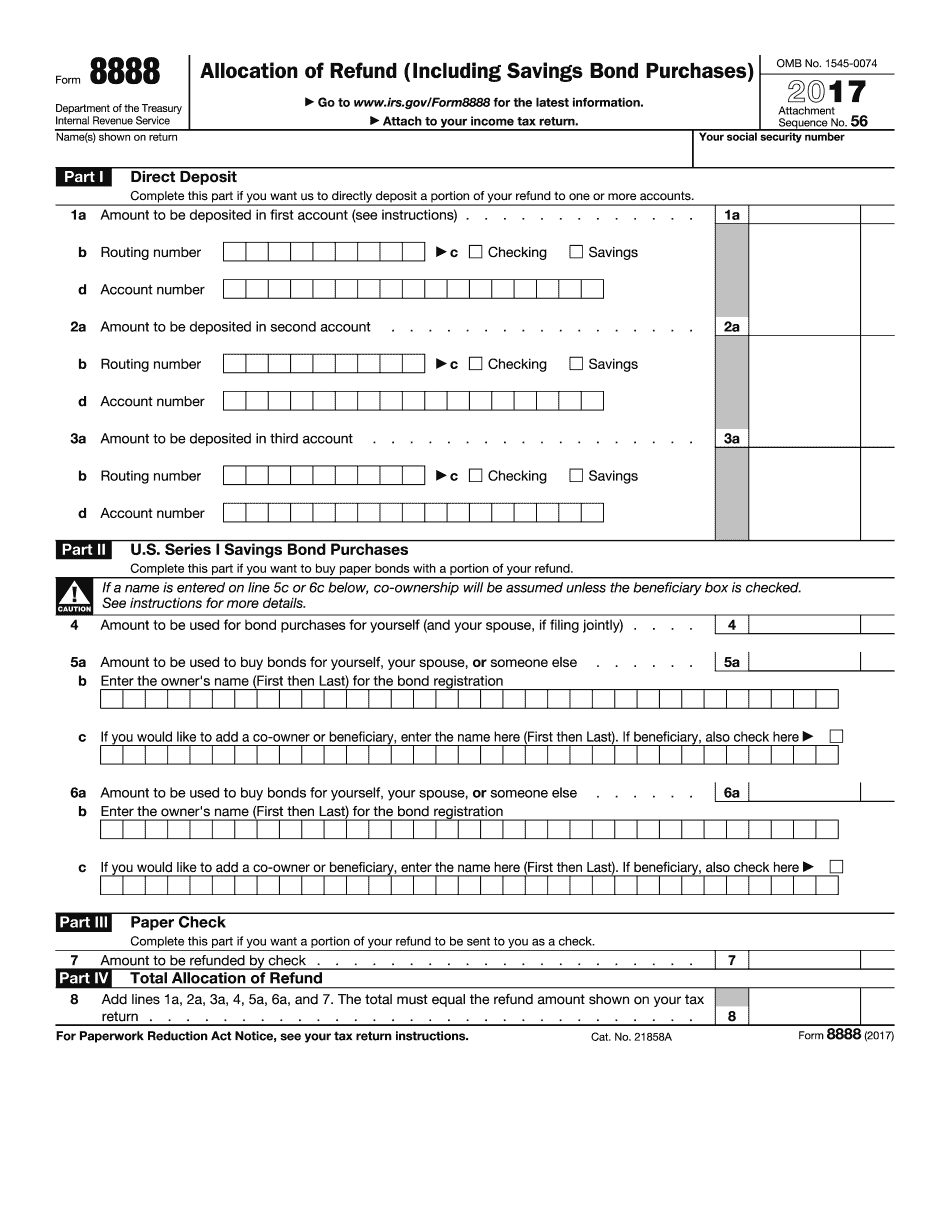

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8888 Rhode Island, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8888 Rhode Island?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8888 Rhode Island aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8888 Rhode Island from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.